Microfinance works

The I-AM Vision Microfinance offers investors access to impact investments and invests primarily in fixed-income investments of carefully selected microfinance institutions (MFIs) in developing and emerging countries. The aim of the microfinance fund is to enable financial inclusion through investments in the poorest countries and thereby initiate sustainable and long-term development that gives low-income people the opportunity to improve their quality of life, create access to sustainable agriculture, community development, renewable energy, medical care and education and subsequently stimulate entrepreneurship so that the people reached can build a livelihood and a future for themselves.

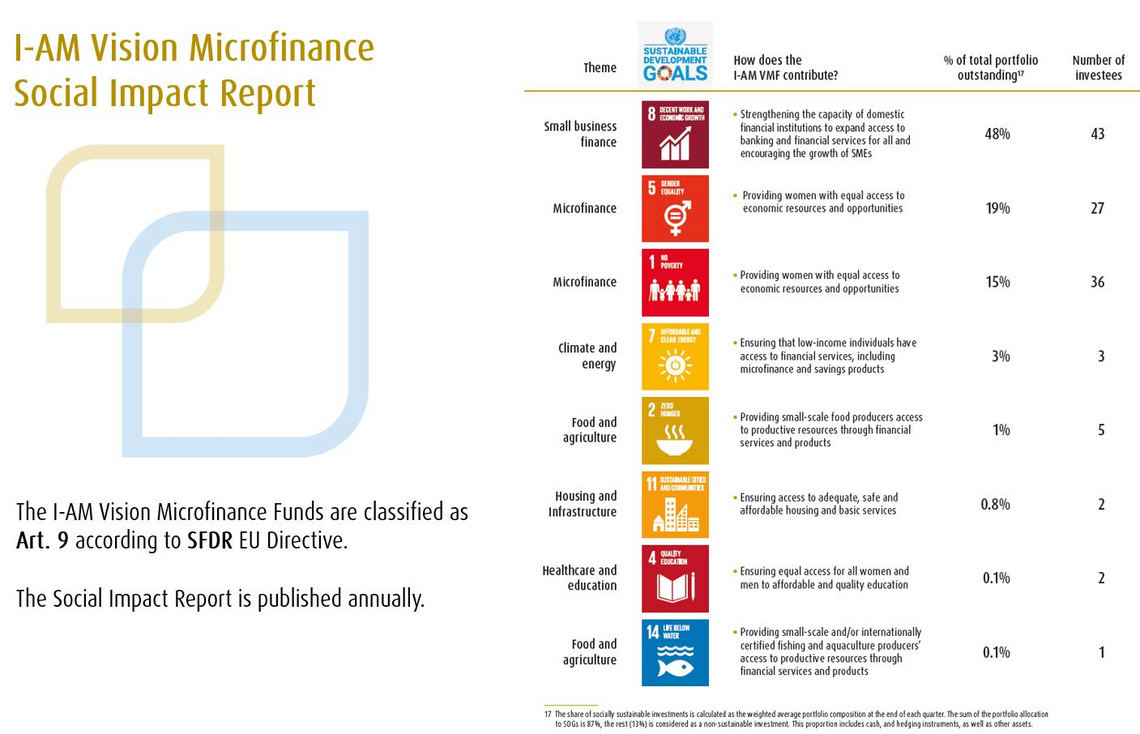

In doing so, the fund makes a positive contribution to the United Nations Sustainable Development Goals (SDGs), including SDG 1 - No Poverty, SDG 5 - Gender Equality and SDG 8 - Decent Work and Economic Growth. The investment fund is also categorized as an Article-9-product in accordance with the Sustainable Finance Disclosure Regulation (SFDR). Since inception in April 2006, the fund has granted more than USD 2.50 billion to 341 different MFIs in 69 countries in the form of 1,392 loans.

Factsheet & Market Commentary

Sustainable investment - Microfinance provides micro-entrepreneurs access to sustainable financial services, to establish a living and to create a future with encouraging prospects. Microfinance institutions (MFIs) provide micro-loans to people who are excluded from the traditional financial sector. Local microfinance institutions are subject to strict auditing to ensure social objectives and requirements are met.

Making a difference - This fund consists generally of fixed-interest investments in carefully selected microfinance institutions in emerging markets. Microfinance investments empower a large number of micro-entrepreneurs to realise their potential and to implement their entrepreneurial ideas.

Fund Information

Factsheet

Market Commentary

Due Diligence Travel Report Mexico 2023

Legal Documents

The basis for the purchase of investment units is the presently valid prospectus, the current versions of the key investor document ("KID" or "KIID"), the statutes of the fund as well as the annual report and, if older than eight months, the semi-annual report. Potential investors may obtain the current German-language versions free-of-charge from Axxion S.A., 15, rue de Flaxweiler, LU-6776 Grevenmacher, and from the swiss representative, First Independent Fund Services AG, Klausstrasse 33, 8008 Zurich. They are also available at www.axxion.lu.